Bitcoin price prediction daily

With the volatility of the cryptocurrency market, predicting the price of Bitcoin can be a challenging task. However, there are various articles that provide insights and analysis to help make informed predictions about the future of Bitcoin. These articles cover different aspects of Bitcoin prediction, including technical analysis, market trends, and expert opinions. By reading these articles, you can gain valuable information to make better decisions when it comes to investing in Bitcoin.

Analyzing Bitcoin Price Trends: A Technical Perspective

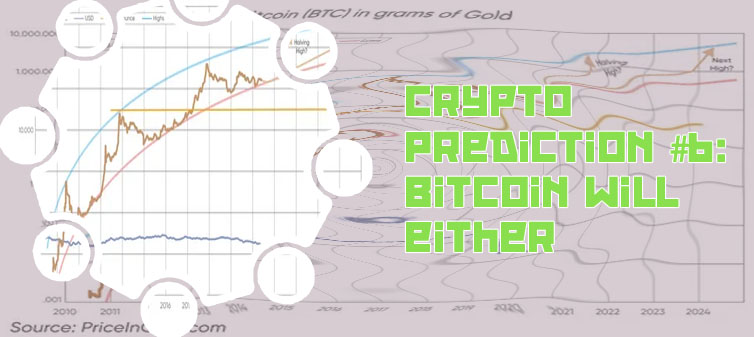

Bitcoin has been making headlines in the financial world recently, with its price reaching new highs and attracting the attention of investors worldwide. One way to make sense of these price movements is through technical analysis, which involves studying historical price data to identify trends and patterns that may help predict future price movements.

In a recent article titled "Analyzing Bitcoin Price Trends: A Technical Perspective," the author delves into the world of technical analysis and examines how it can be applied to Bitcoin price data. The article explores various technical indicators such as moving averages, RSI, and MACD, and explains how they can be used to analyze Bitcoin price trends.

One key takeaway from the article is the importance of using multiple indicators in conjunction with each other to get a more comprehensive view of the market. By combining different indicators, traders can better understand the underlying trends driving Bitcoin's price movements and make more informed trading decisions.

Overall, "Analyzing Bitcoin Price Trends: A Technical Perspective" provides valuable insights into how technical analysis can be used to analyze Bitcoin price trends. The article is important for anyone interested in understanding the factors influencing Bitcoin's price movements and gaining a deeper insight into the cryptocurrency market.

Expert Opinions on the Future of Bitcoin: What to Expect

In the ever-evolving landscape of cryptocurrency, Bitcoin continues to be at the forefront, captivating the attention of investors, technology enthusiasts, and financial experts alike. The future of Bitcoin remains a topic of intense speculation, with opinions varying widely on what to expect in the coming years.

Many experts believe that Bitcoin will continue to gain mainstream adoption, as more and more institutions and individuals recognize its potential as a store of value and a hedge against inflation. With the recent endorsement of major companies such as Tesla and Square, the legitimacy of Bitcoin as a viable asset class has been further solidified.

One practical use case of Bitcoin that exemplifies its positive impact is in the realm of cross-border remittances. Traditional remittance services often come with high fees and long processing times, particularly for individuals sending money to developing countries. By using Bitcoin, individuals can transfer funds across borders quickly and at a fraction of the cost, providing a much-needed lifeline to those in need.

As we look towards the future of Bitcoin, it is clear that the potential for growth and innovation is vast. While there are risks and uncertainties inherent in any investment, the positive momentum surrounding Bitcoin suggests that it will continue to play a significant role in shaping the future of finance.

Market Indicators to Watch for Bitcoin Prediction Day

With the increasing popularity of Bitcoin, investors are constantly looking for market indicators to help them make informed decisions on Bitcoin Prediction Day. These indicators can provide valuable insights into the future direction of the cryptocurrency market. Here are some key market indicators that investors should watch:

-

Trading Volume: One of the most important indicators to watch is the trading volume of Bitcoin. High trading volume typically indicates increased market activity and interest in the cryptocurrency. A sudden surge in trading volume could signal a potential price movement.

-

Moving Averages: Another important indicator is the moving averages of Bitcoin's price. By analyzing the moving averages, investors can identify trends and potential support or resistance levels. The 50-day and 200-day moving averages are commonly used by traders to gauge the overall market sentiment.

-

Relative Strength Index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. A high RSI value indicates that Bitcoin may be overbought, while a low RSI value suggests that it may be oversold. Investors can use the RSI to determine potential entry and exit points.

-

Market Sentiment: Monitoring market sentiment through social media, news articles, and forums can also provide valuable insights into the market's overall outlook. Positive sentiment could